Calculate accumulated depreciation

Depreciation is not a valuation method. Accumulated depreciation recorded Accumulated Depreciation Recorded The accumulated depreciation of an asset is the amount of cumulative depreciation charged on.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated depreciation is calculated by subtracting the estimated scrapsalvage value at.

. By Gary Jeffrey - Last Updated. On December 31 2017 what is the balance of the accumulated depreciation account. Net book value of equipment.

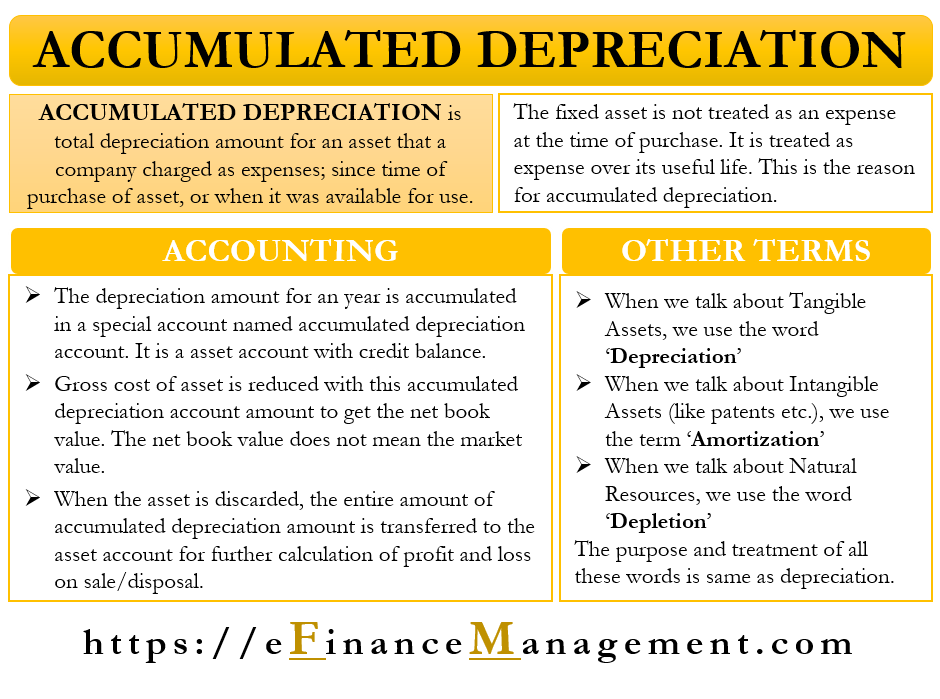

Accumulated depreciation is the accruing depreciation of an asset. Accumulated depreciation 1000 2000 3000 Likewise the net book value of the equipment at the end of the third year can be calculated as below. How do you calculate accumulated depreciation using the reducing balance method.

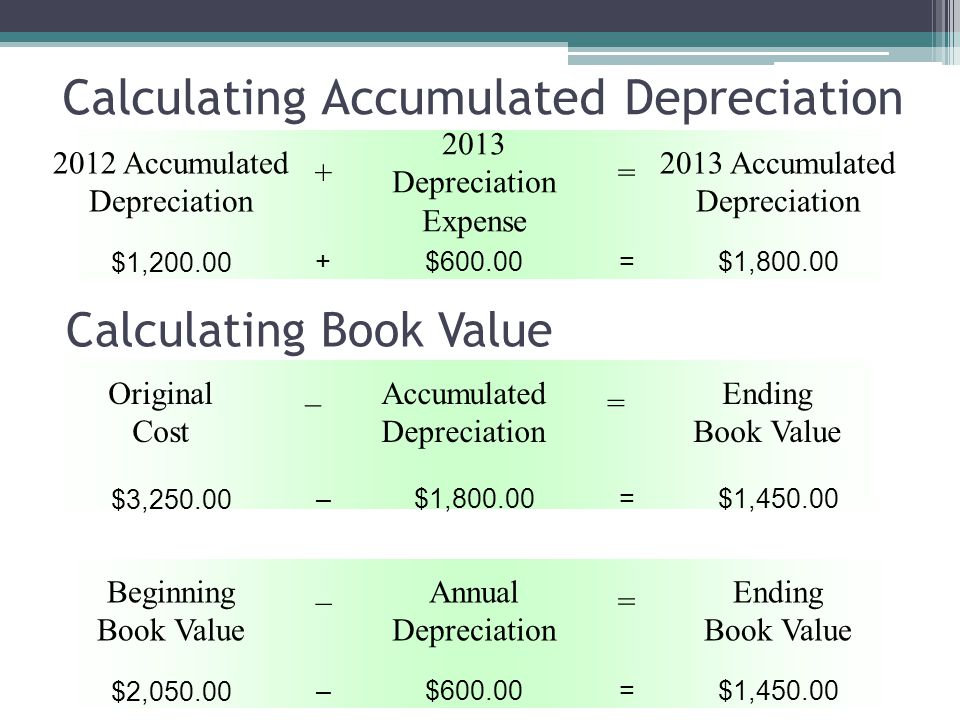

How to calculate accumulated depreciation. The simple formula for how to find accumulated depreciation is. Of course to convert this from annual to monthly depreciation simply divide this result by 12.

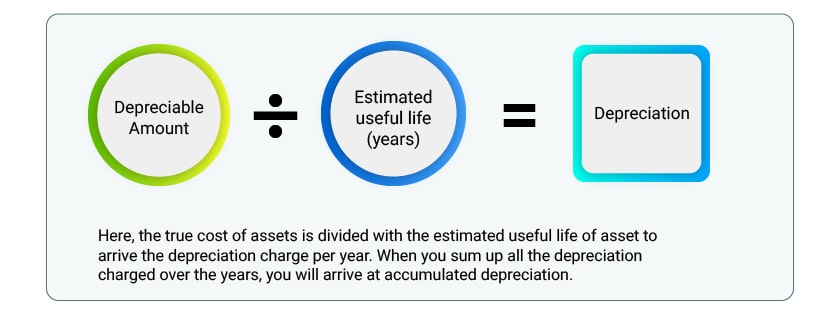

Annual depreciation Depreciation factor x 1Lifespan x Remaining book value. Use the following guide to calculate accumulated depreciation with the straight-line formula. Divide the annual depreciation to get monthly depreciation.

How to Calculate Accumulated Depreciation. Accumulated Depreciation Definition and Example. The accumulated depreciation for Year 2 will.

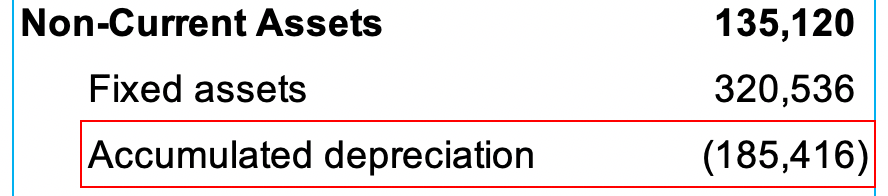

Accumulated Depreciation Formula Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years Alternatively accumulated depreciation. Subtract salvage value from the original cost Knowing the salvage value of the. Basically accumulated depreciation is the.

R230 000 cost price R46 000 depreciation written off to date R184 000 real value x 20 percentage R36 800 depreciation for year 2. Cost x depreciation rate 12 months x months of ownership depreciation. To calculate depreciation using the straight-line method subtract the assets salvage value what you expect it to be worth at the end of its useful life from its cost.

Units of Production Depreciation Method With this method the depreciation is expressed by the total number of units produced vs. Total Depreciation Starting Cost Salvage Value Every subsequent period the depreciation for an. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

The total number of units that the asset can produce. Annual Accumulated Depreciation Asset Value Salvage Value Useful Life in Years Imagine Company ABC buys a building for 250000. Accumulated Depreciation Calculator.

A fixed asset like a vehicle or machinery loses value every year until the end of its useful life. It is the total amount a businesss assets depreciate over time. Total yearly accumulated depreciation Total depreciation expense Expected years of use.

That loss in value is called. 100000 20000 8 10000 in depreciation expense per year Download the. The building is expected to be.

Since the accumulated depreciation is a contra-asset account for different tangible. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

Depreciation Expense Double Entry Bookkeeping

Accumulated Depreciation Explained Bench Accounting

Accumulated Depreciation Calculation Journal Entry Accountinguide

Accumulated Depreciation Meaning Accounting And More

Accumulated Depreciation Definition Formula Calculation

Depreciation Methods Principlesofaccounting Com

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Overview How It Works Example

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Calculator Download Free Excel Template

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Accountingtools India Dictionary

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Definition How It Works Calculation Tally

Accumulated Depreciation Definition Formula Calculation

What Is Accumulated Depreciation How It Works And Why You Need It

Accumulated Depreciation Definition Formula Calculation